COMP4801 Final Year Project

Students: Wong Yee Wang(3035788637),

Lam Kwong Chiu (3035927427)

Supervisor: Dr. Kam Pui Chow

About The Project

A web-based platform designed for the backtesting and optimization of futures trading strategies, aimed at helping retail traders evaluate and refine their strategies using historical market data.

Features

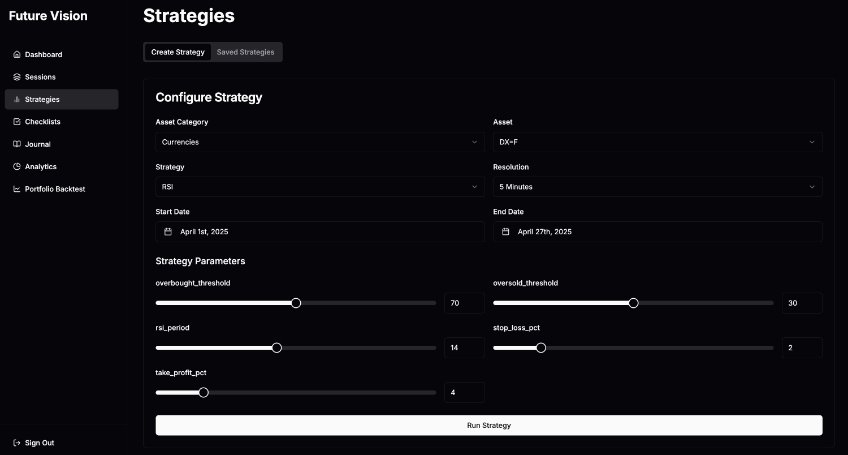

Strategy Backtesting

The Default Strategies with Parameter Adjustment method is developed to assist users with minimal or no prior experience in futures trading.

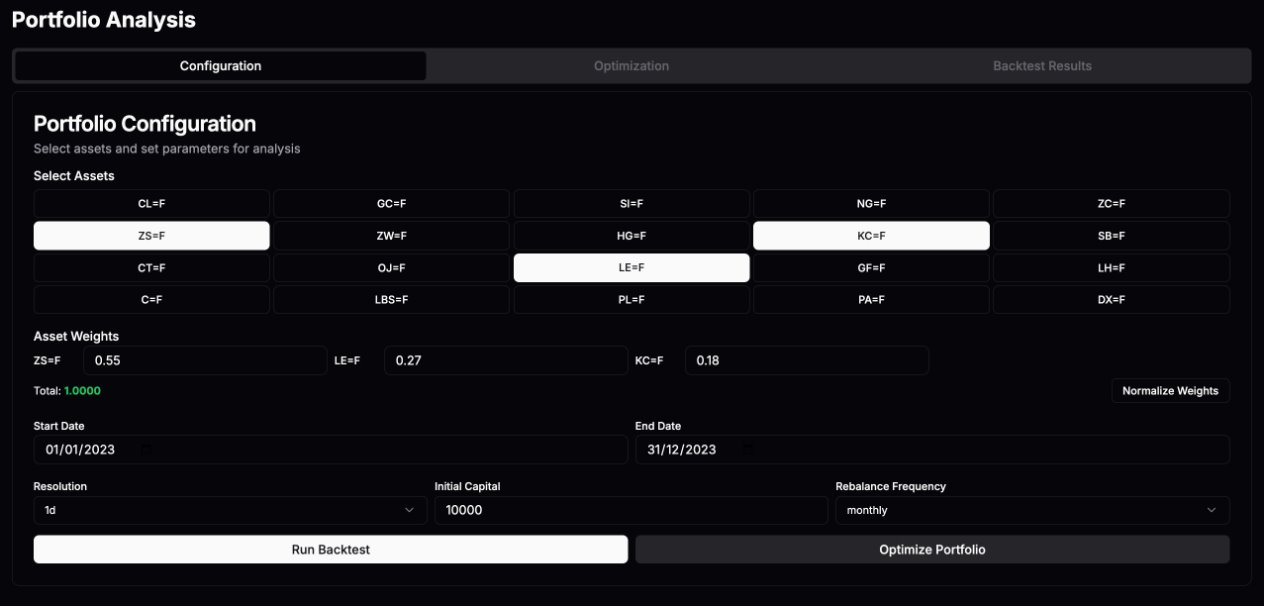

Portfolio Backtesting

The Portfolio Backtesting feature is designed to assess the performance of a collection of

assets collectively, rather than focusing solely on individual trades.

Portfolio Optimization

The system provides a suggested optimal asset allocation, accompanied by the projected annual return, volatility, Sharpe ratio, and the expected performance based on the optimized portfolio configuration.

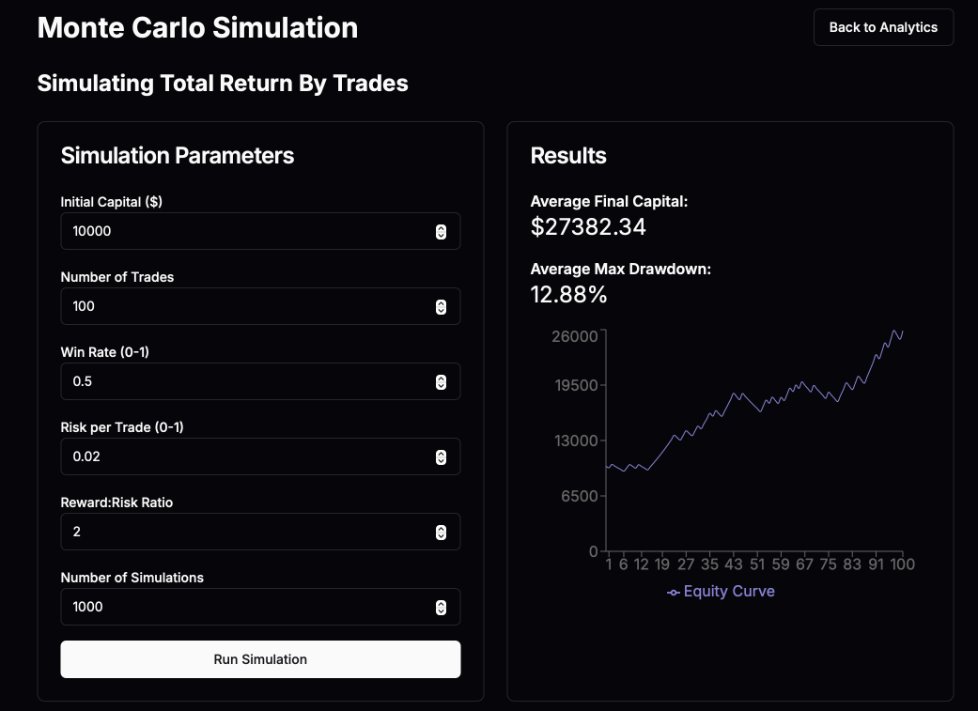

Monte Carlo Simulation

The Monte Carlo Simulation method employs statistical modeling techniques to evaluate the

robustness and potential performance of trading strategies under diverse and uncertain market conditions.

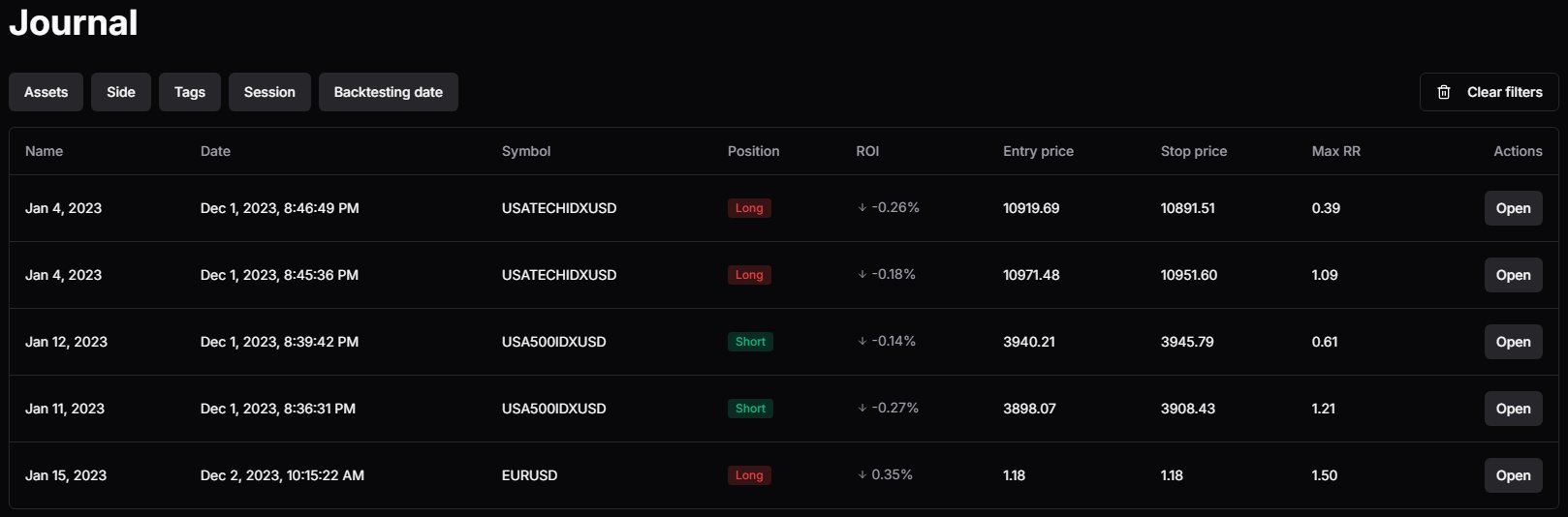

Journaling

Journaling provides trade documentation, outcome evaluation and market review. Help traders adhering to a structured evaluation framework

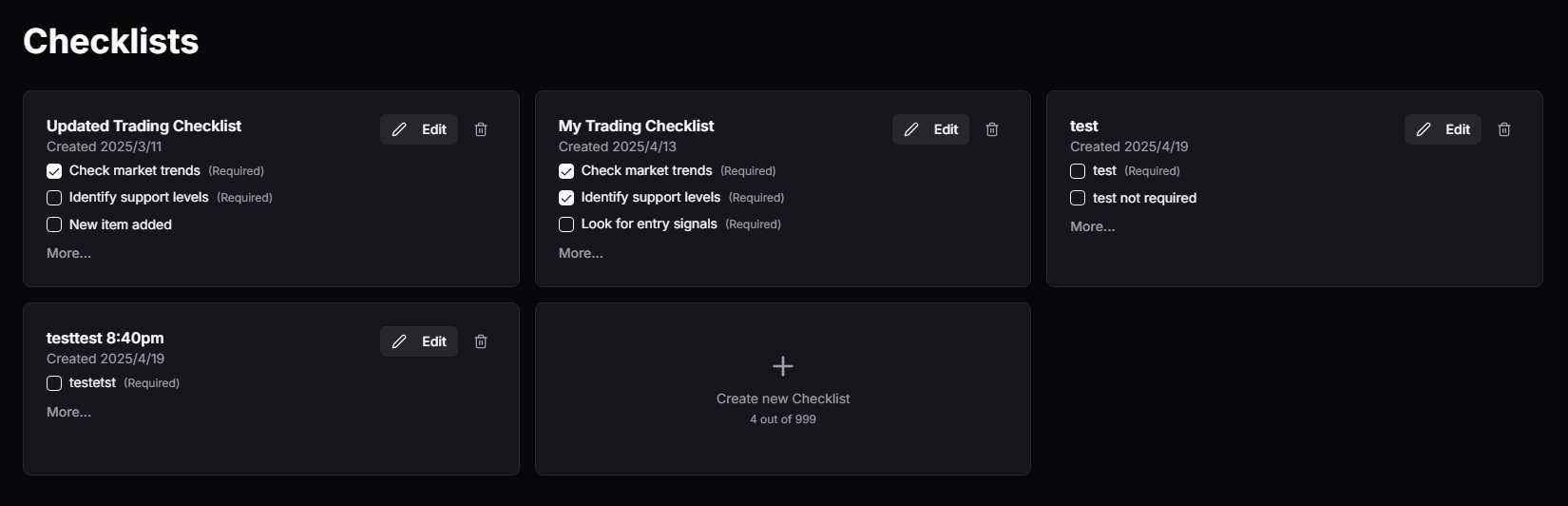

Checklist

Checklist provides setup verification and risk management assurance. Help traders improving the effectiveness of their trading strategies.