Result

Stock Price Movement Prediction Model Using LSTM

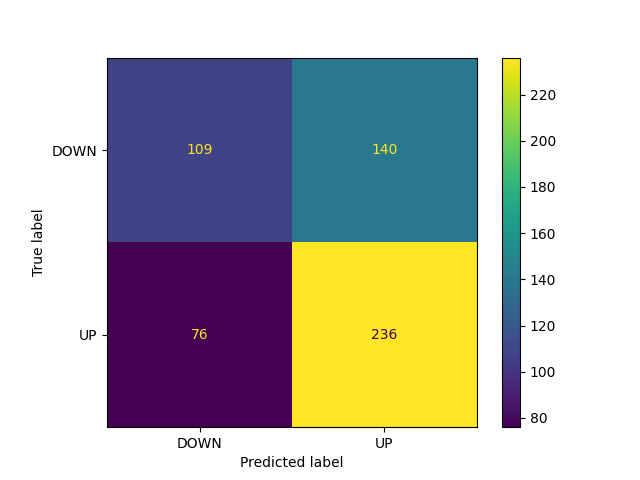

The LSTM model was evaluated on the test set for each of the top 10 Nasdaq stocks. Performance metrics, including the accuracy, precision, recall, and F1-score, were calculated from the confusion matrices. For exapmple, for AAPL stock.

Average accuracy of approximately 0.6 across 10 stocks.

Last interim report average accuracy of 54%.

62.8% of the predicted UP movements were correct.

Recall indicates model identifies about 69.6% of actual UP movements.

F1-score with an average of0.656, reflecting a reasonable trade-off between the two metrics.

Baseline Numerical Stock Price Prediction Model Using ARIMA

The model forecasts daily closing prices, serving as a statistical baseline for comparison with deep learning approaches.

The methodology includes stationarity testing, model training, and evaluation using RMSE, MAE, and MAPE metrics.

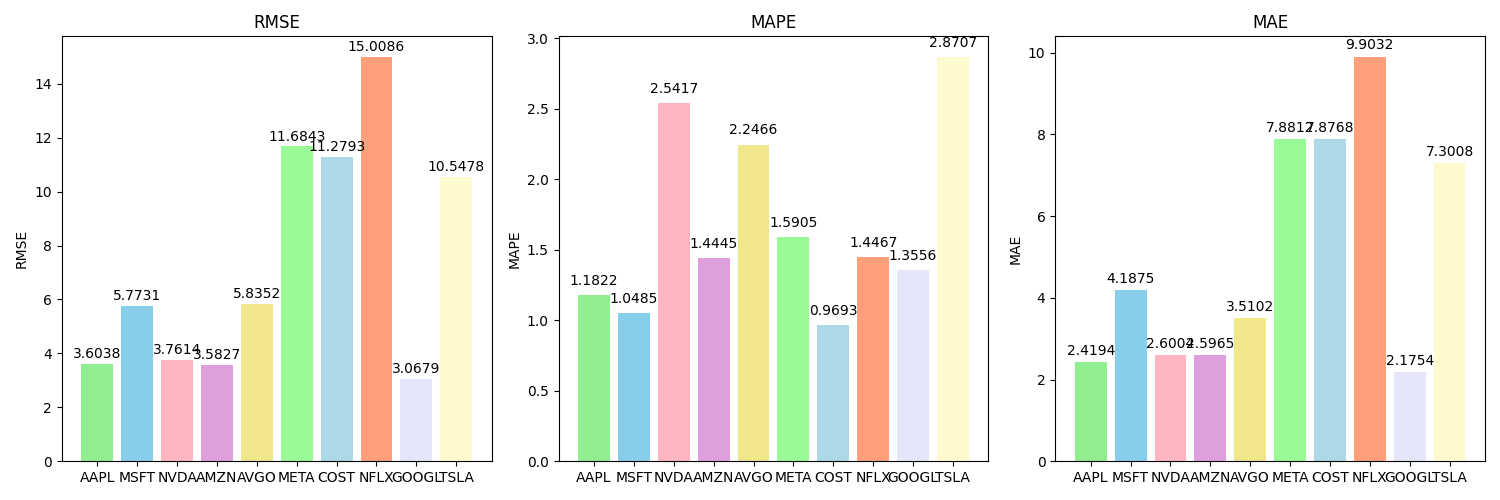

The ARIMA(7, 1, 0) Model Results with RMSE, MAPE, and MAE.

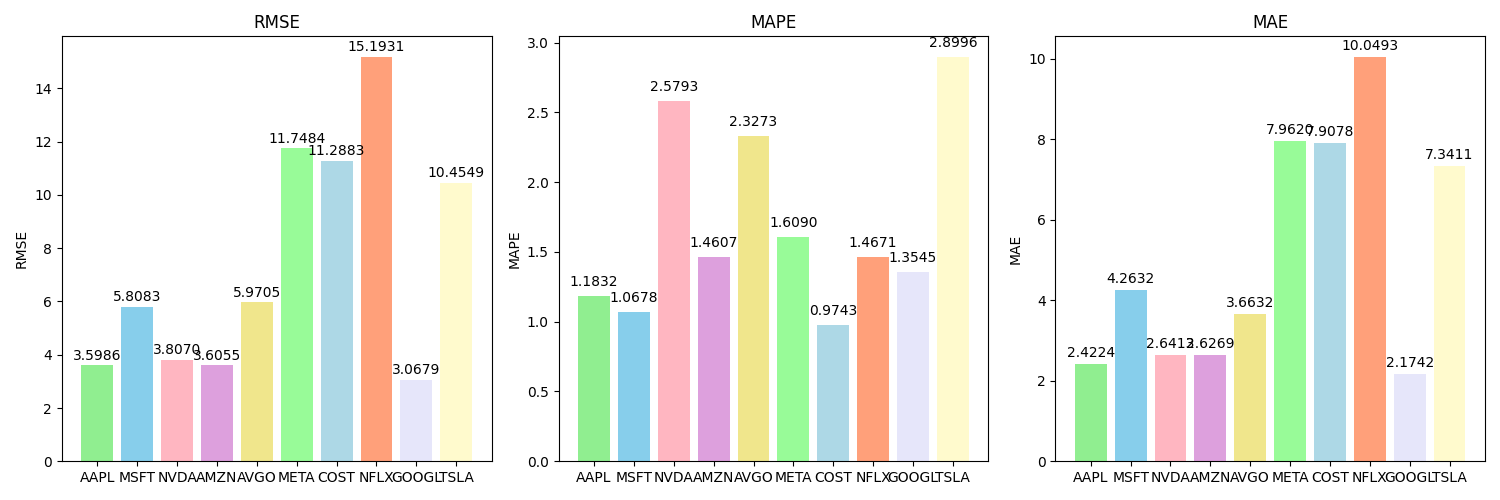

The ARIMA(15, 1, 0) Model Results with RMSE, MAPE, and MAE.

The ARIMA(7,1,0) model generally outperforms the ARIMA(15,1,0) model across most stocks, with lower average MAPE (1.53% vs. 1.69%), RMSE (7.41 vs. 7.45), and MAE (5.05 vs. 5.11).

This suggests that a shorter look-back period of 7 days is more effective for capturing short-term price patterns in this dataset.

The ARIMA(15,1,0) model’s slightly higher errors may result from overfitting to longer-term patterns that are less relevant for daily forecasts.

Numerical Stock Price Prediction Using Deep Learning Models

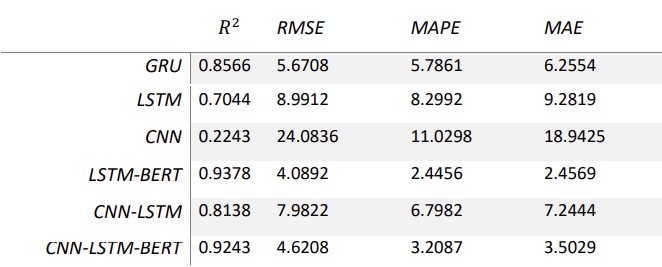

Summarization Table of the Results of Six Deep Learning Over the 7-Day Forecast Horizon

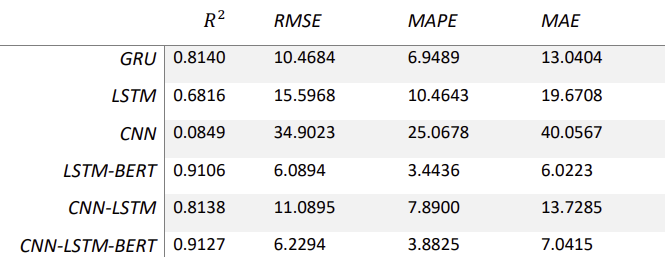

Summarization Table of the Results of Six Deep Learning Over the 15-Day Forecast Horizon

7-Day Forecast Comparison

The best deep learning model, LSTM-BERT, has a MAPE of 2.4456%, which is 60% higher than ARIMA’s, despite a better RMSE (4.0892) and MAE (2.4569).

LSTM-BERT excel in MAE and RMSE, their higher MAPE indicates that ARIMA is more accurate in relative terms.

15-Day Forecast Comparison

LSTM-BERT, reports a MAPE of 3.4436%, nearly double ARIMA’s, despite a lower RMSE (6.0894) and comparable MAE (6.0223).