Research Approach

The project adopts a behavior-based detection approach tailored to the pseudonymous and price-agnostic nature of fashion NFTs.

Instead of relying on identity or price data, laundering risk is assessed through observable wallet activity and transaction structures.

Data Collection

Data was sourced from the Ethereum blockchain using Google BigQuery.

The selected contract was RTFKT CloneX, one of the most actively traded fashion NFT collections.

The sample period was from December 14, 2024 to March 14, 2025, containing 1,449 transactions across 713 wallets.

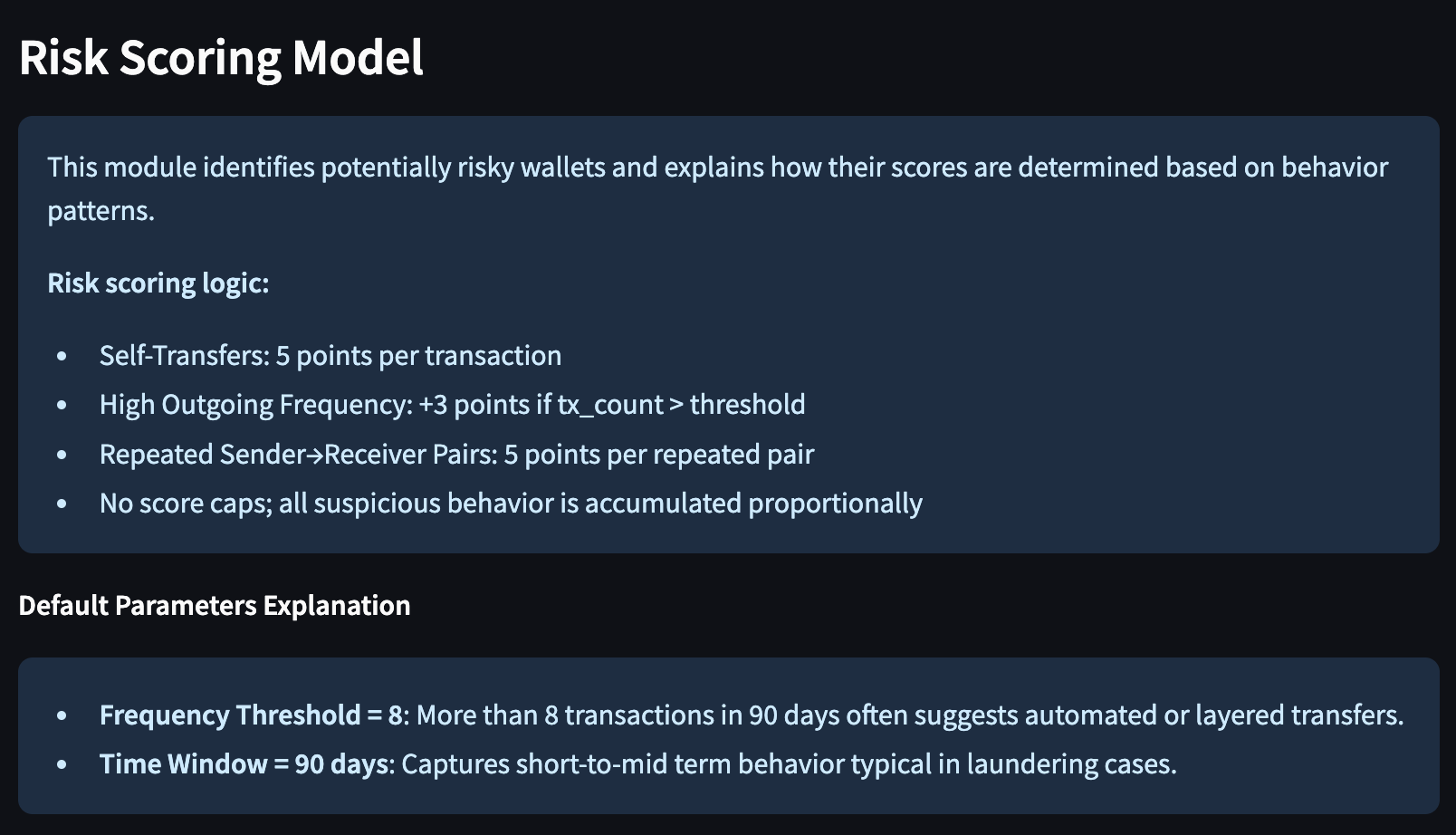

Behavioral Risk Scoring

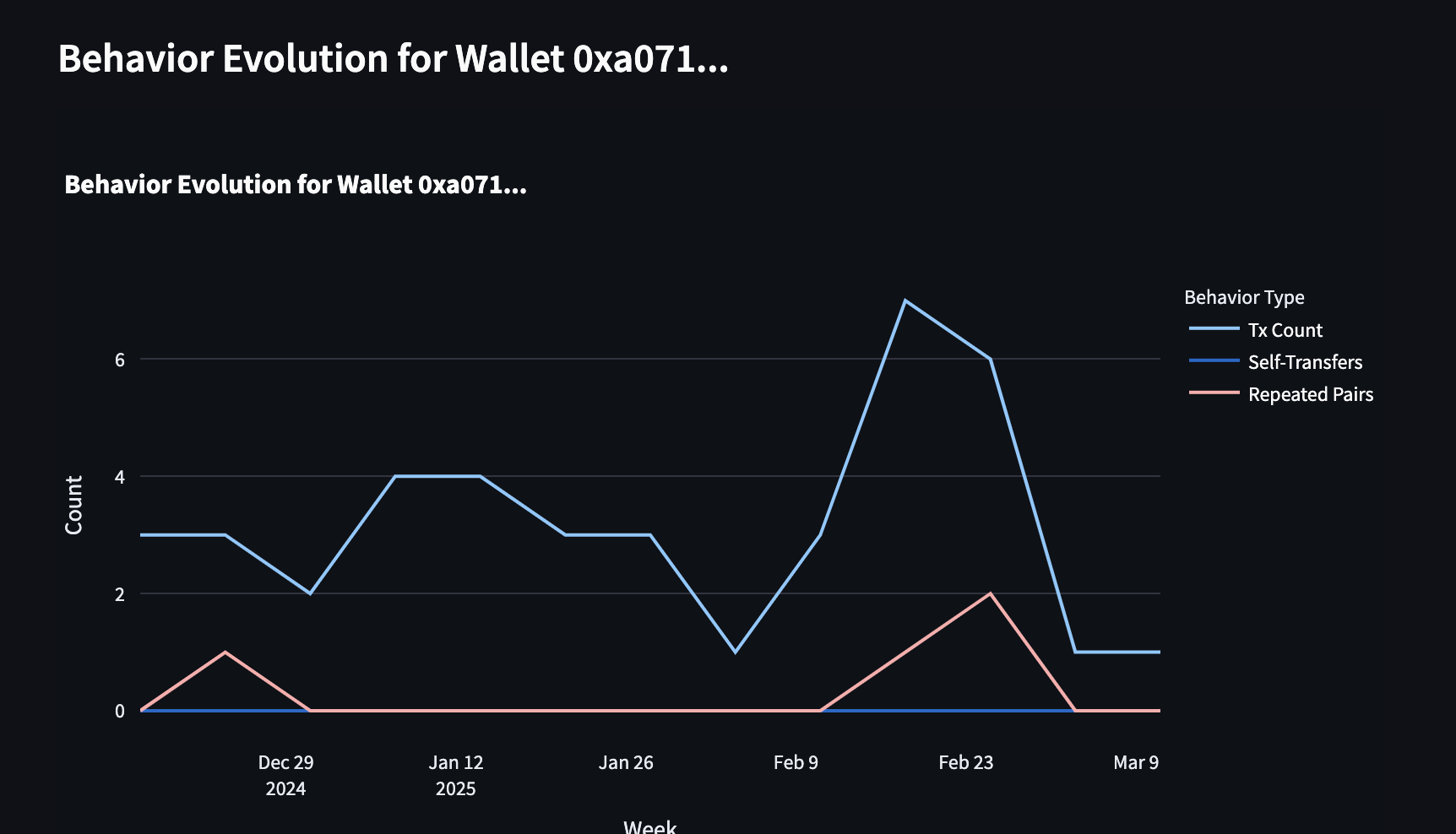

A rule-based scoring model was developed based on three laundering red flags:

- Self-transfers – sending NFTs to oneself or controlled wallets

- High-frequency trading – more than 8 transactions in 90 days

- Repeated counterparties – multiple trades with the same address

Each behavior contributes to a wallet’s cumulative risk score, with thresholds calibrated using the 90th percentile of transaction volume.

Scores are fully explainable and designed for transparency in compliance review.

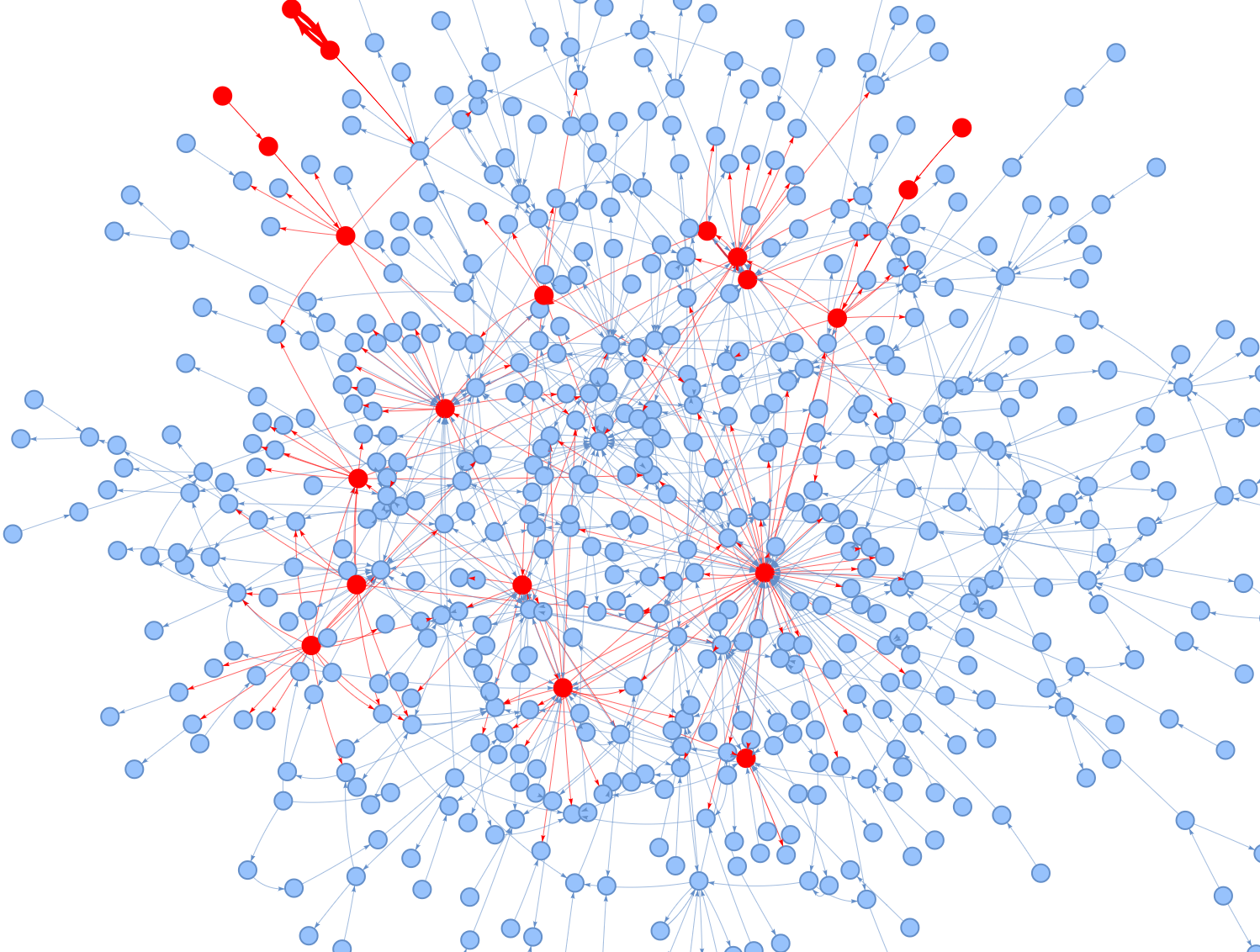

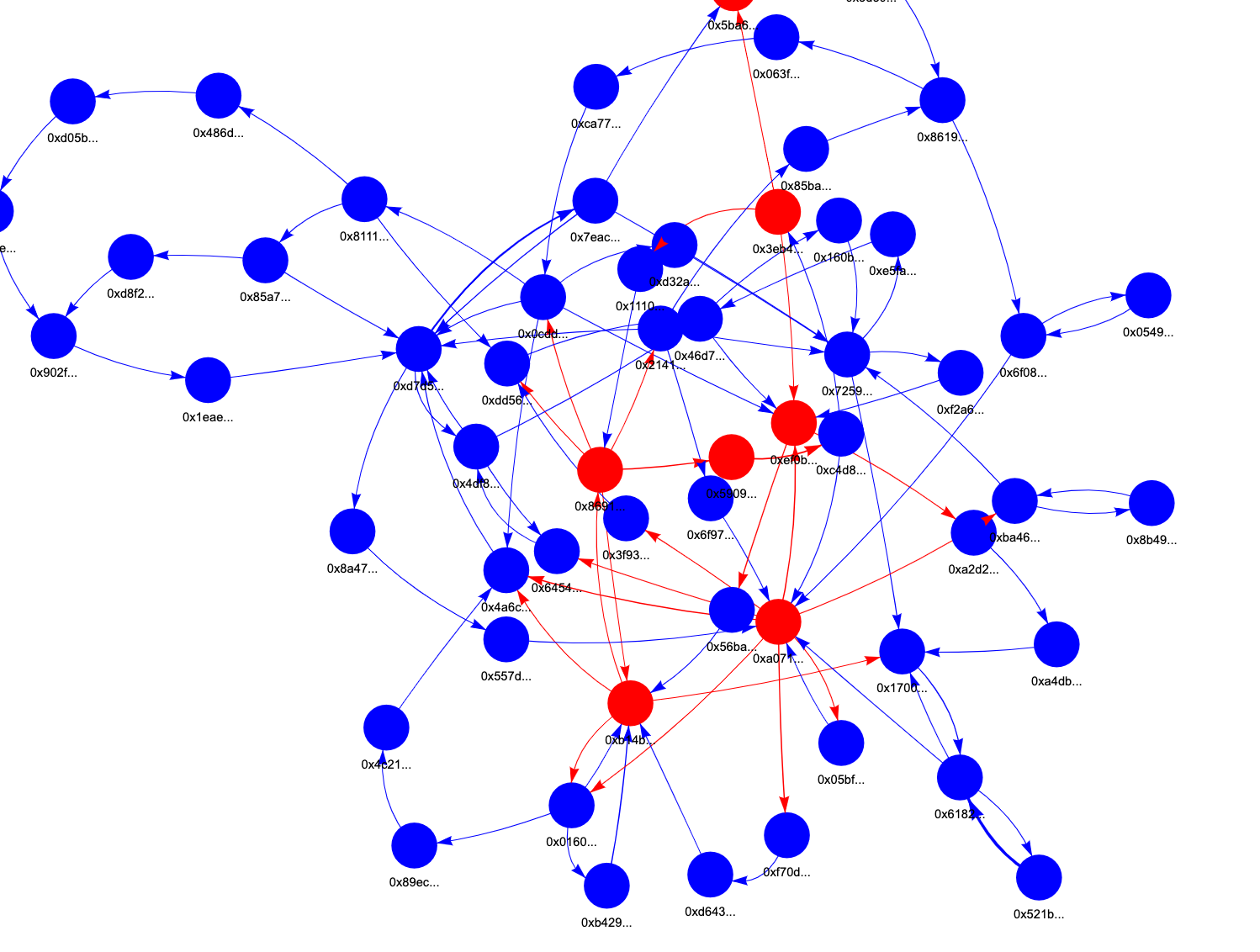

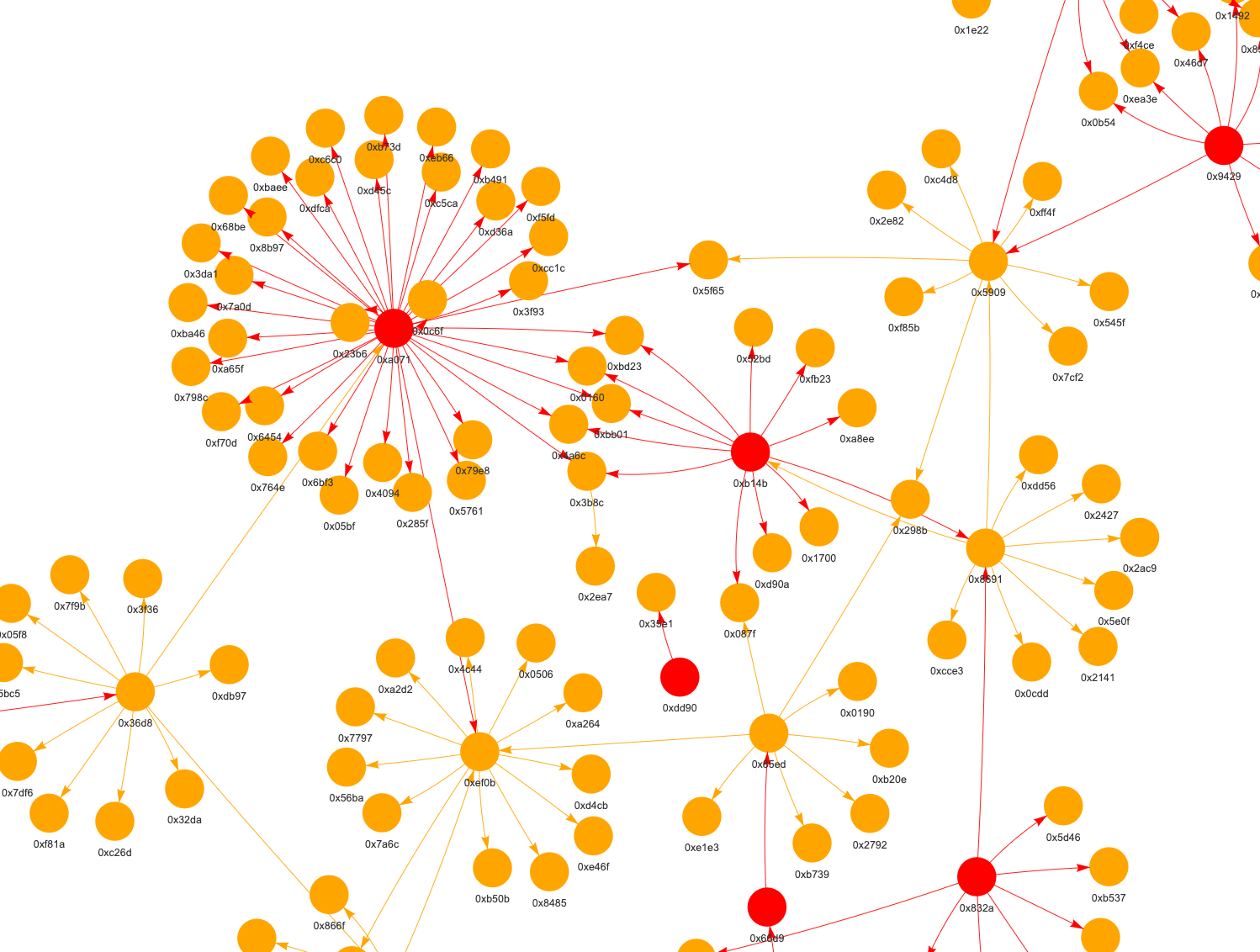

Graph Analysis

In addition to behavior scoring, transaction graphs were constructed using NetworkX in Python.

This uncovered risk structures such as:

- Circular flows – tokens looping back to original senders

- Strongly Connected Components (SCCs) – tight clusters of mutual trades

- Dispersal hubs – one wallet distributing to many recipients

Wallets involved in these structures were significantly more likely to have high behavior scores.

Tools & Technologies

- Python: Data cleaning, scoring logic, and graph modeling

- NetworkX: Structural analysis of transaction networks

- Google BigQuery: On-chain data extraction from Ethereum

- Streamlit + Plotly: Dashboard development and visualization